Personalized Banking

This is a 2 week project for a banking company. The goal of this POC is to ideate on new ways of engaging potential customers through the Financial Survey and how to create a long-term engagement.

*Visuals in this page are altered due to project NDA.

Role:

User Research, User Interface, User Experience

Tools:

Figma, Invision

Approach

We started off with doing research on existing applications that are within the Financial category. The persona that we aimed at was someone who is just getting started to figure out their financial situation and isn't sure where to start. It was important to see what each one offers and why a user would want to use those features. This was helpful for discovering what a person who is new to learning about their financials would prioritize.

Key Takeaway & Proposal

We wanted to ensure that when the user takes the Financial Quiz, they will be able ways to route the appointment to the right advisor based on survey questions, reduce wait time and provide the right information to the advisor and understand technical dependencies and data requirements.

To do this, we proposed creating a personalized experience, where we can direct clients to recommendations to banking products that actually meet their needs, provide transparency to potential clients that personal information is collected for a reason, and leveraging AI/ML to adopt a new mindset that products offered mean something and can help them to be financially savvy.

Information Architecture

Financial Quiz

The goal for this quiz was to engage the user with additional support once they reached their results page. Copywriting took a major role in setting the tone of the quiz. We wanted the user to not feel intimidated by putting in their personal information, which is why we have options such as "I dont want to tell you yet" as a way to make them feel more comfortable about what information the bank can collect.

We also prompted them for next steps after the quiz to further engage their activity time on the app and to provide them with useful information and next steps based on their quiz results.

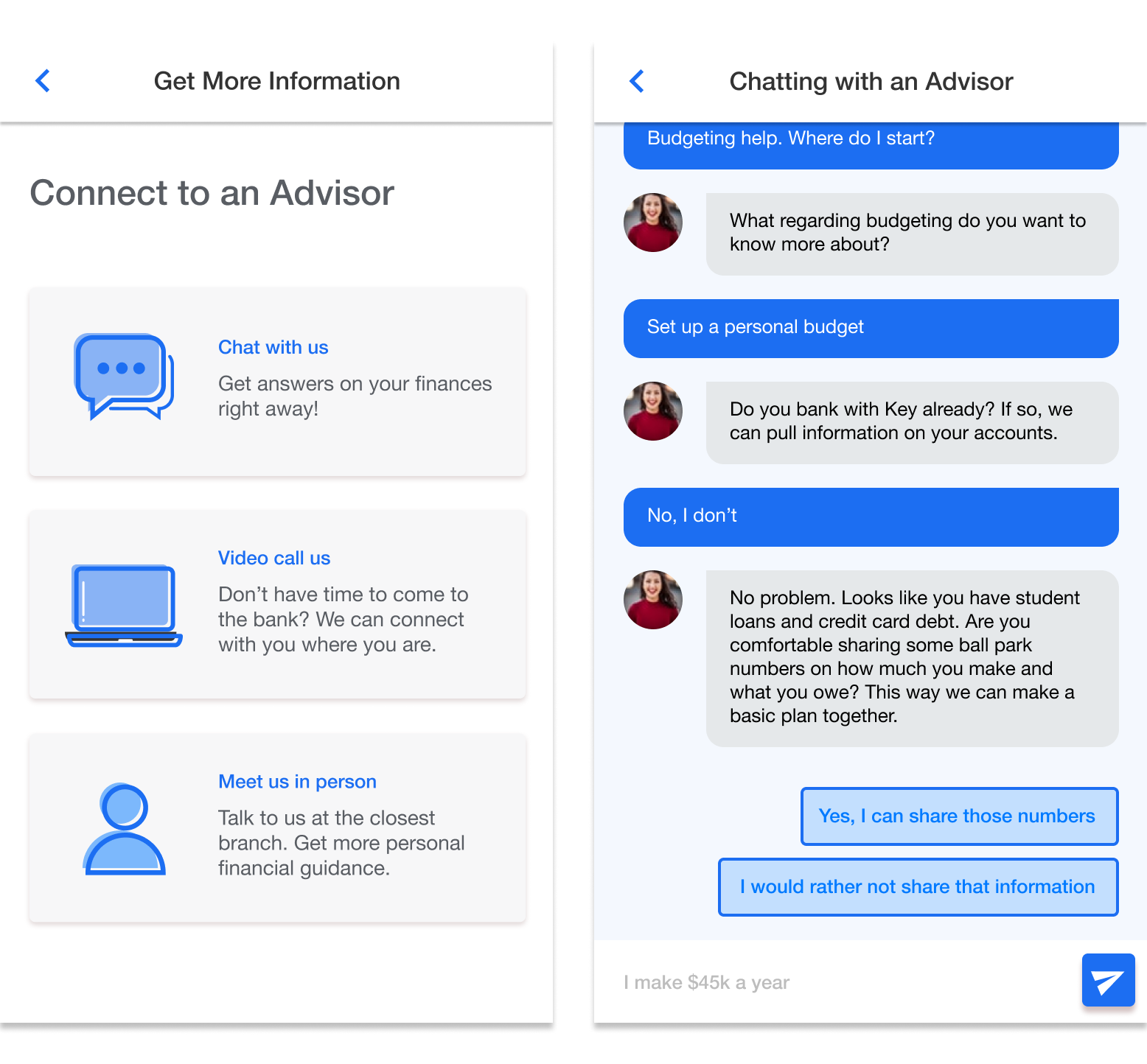

Online Support

One of the pain points that we wanted to re-imagine is the communication between an advisor and the client. We proposed three different chat options that they can do directly within the app, making this step more engaging. It also prompts the user to ask questions right away based on their quiz result, allowing them to get a deeper understanding of their current financial situation.

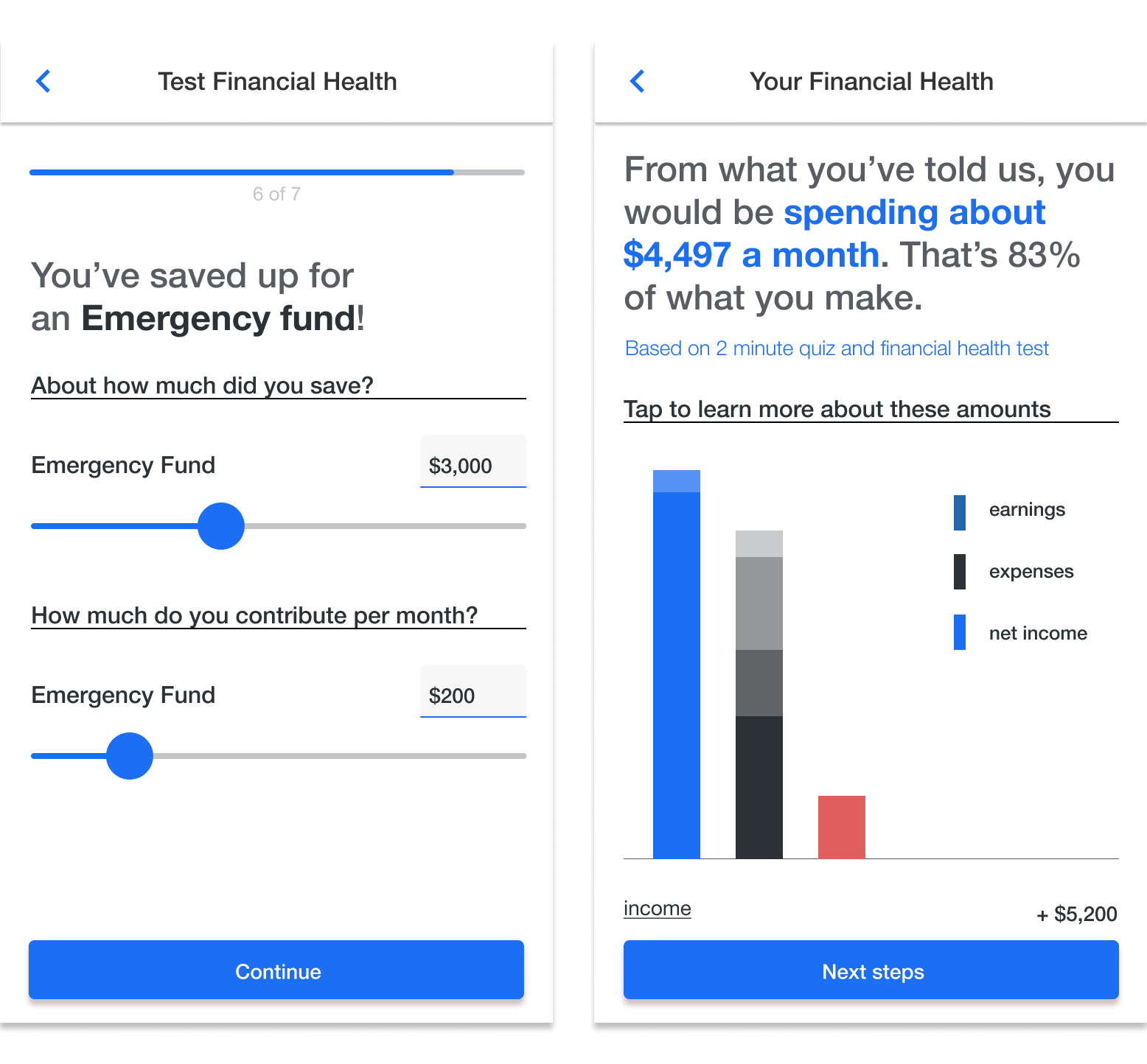

Financial Health

Once the user has created an account on the app, they will have the option to input information so the bank can get a general understanding of their current financial health. From answering a set of short questions, they will get a visual overview of their spendings based on their earnings, and they can save this report by inputting their email address.

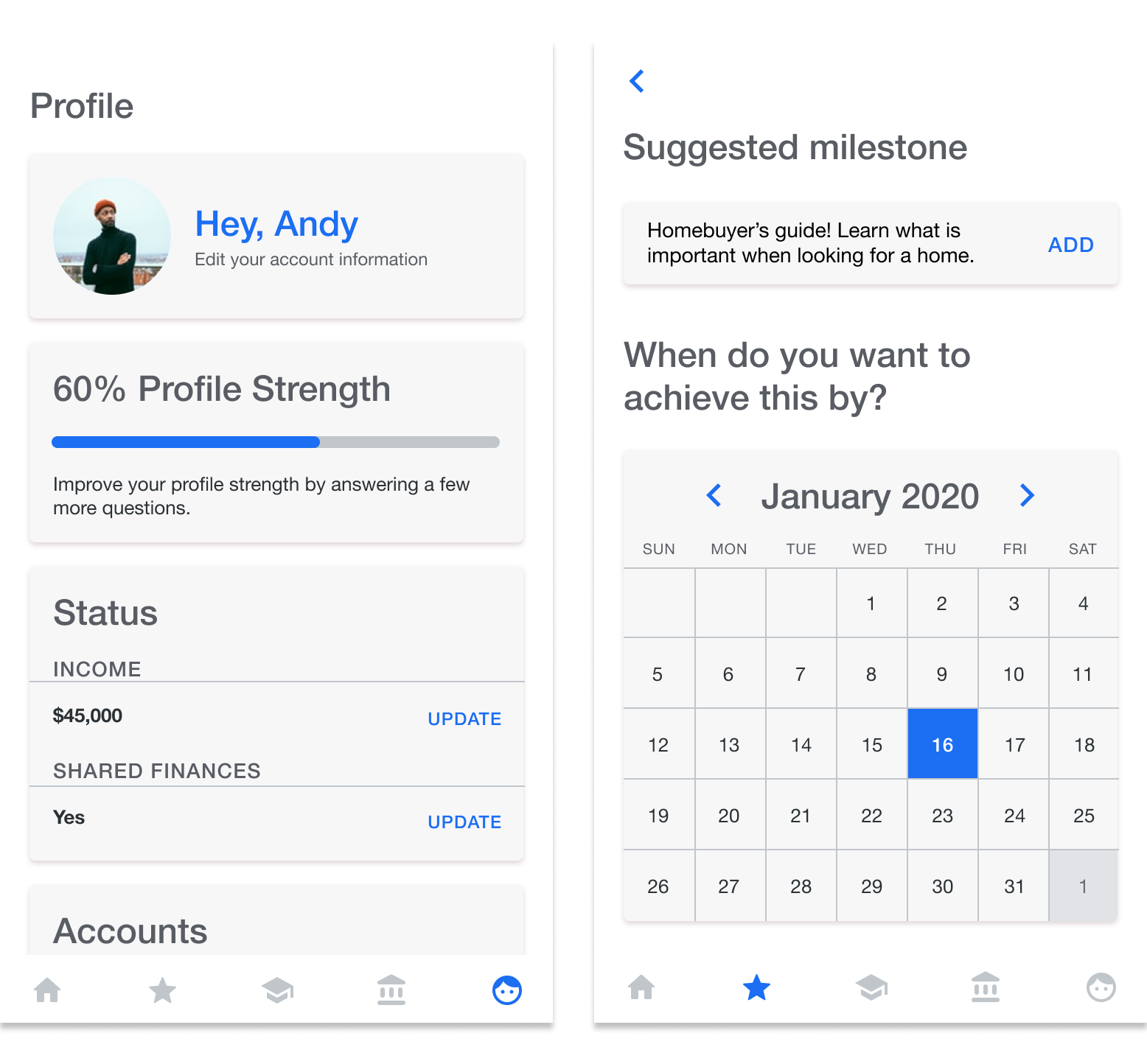

Financial Wellness

We also included a Goals tracker feature for the user to determine their financial wellness. This means that they are able to visually see their self-set budget, input goals and track their progress. This way, the user is able to see how their data is being used and have continuous financial support on the app.

Result

For the next steps of this POC, I would like to spend time on User Testing the flow and testing out the copy to ensure that it is efficient and on-brand. As this was completed on a tight deadline, I would have like to spend more time going through the quiz content and proposing more effective flows that leads after the result. This POC has been developed as well, feel free to send me an email if you're interested in the full flow!